Business Insurance in and around Hillsboro

One of Hillsboro’s top choices for small business insurance.

This small business insurance is not risky

- Kansas

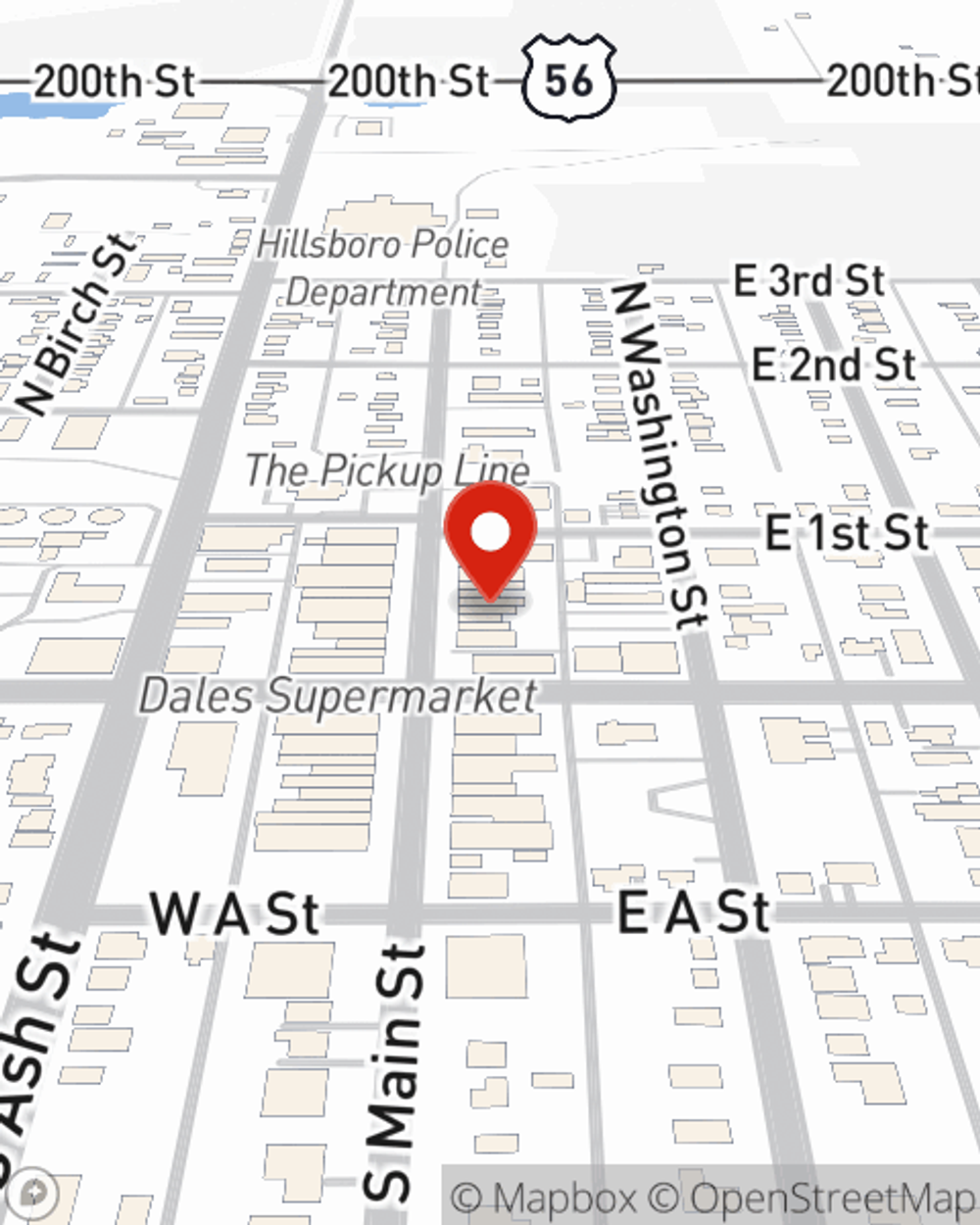

- Hillsboro, KS

- Marion, KS

- Marion County, KS

- Goessel, KS

- Hesston, KS

- Tampa, KS

- Canton, KS

- Herington, KS

- Peabody, KS

- Strong City, KS

- Lindsborg, KS

- Burns, KS

- Moundridge, KS

- Lincolnville, KS

- Cottonwood Falls, KS

- Galva, KS

- Hope. KS

- Abilene, KS

- Council Grove, KS

- Newton, KS

- Halstead, KS

- Valley Center, KS

Help Prepare Your Business For The Unexpected.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes accidents like a staff member getting hurt can happen on your business's property.

One of Hillsboro’s top choices for small business insurance.

This small business insurance is not risky

Cover Your Business Assets

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or extra liability, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Becky Walsh can also help you file your claim.

Take the next step of preparation and visit State Farm agent Becky Walsh's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Becky Walsh

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.